Following on from part one, The rise of digital agriculture and dispossession in Africa: implications for smallholder farmers, part two looks at how private-sector interests and motives are driving the financialisation of Africa’s food and farming systems.

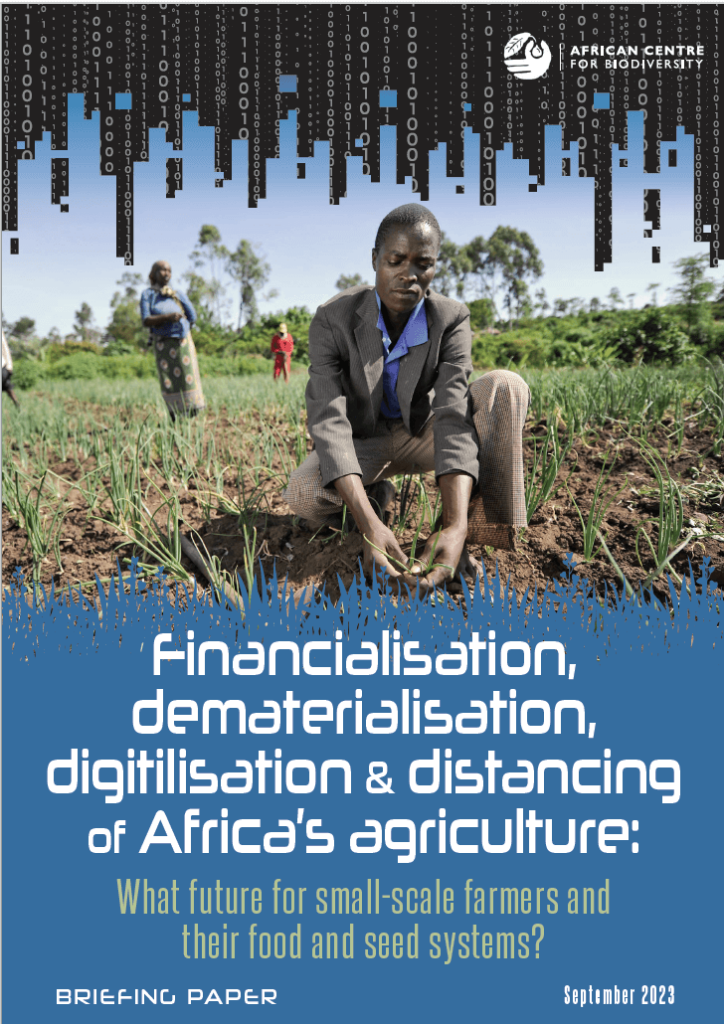

This paper explores the consequences of financialisation, which include the marginalisation of human rights, particularly as relating to land access and ownership. It looks into financialisation related to seed breeding and seed-related research and development finding that seeds are increasingly viewed as digital commodities.

The consequences of financialisation are growing corporate dominance in all elements of the food chain, reduced funding into the real economy and an increased focus on delivering short-term returns. Real-world systems are ruptured.

This paper describes key financial instruments like futures and derivatives trading markets, and index funds. It also explores the financialisation of climate change and the role of public private partnerships. Significant financialisation actors are identified, such as banks, asset management funds, large institutional investors and philanthropic organisations. Agricultural commodity trading companies are engaged with financialisation instruments like derivatives, as are global energy traders. Digitalisation is an enabler of financialisation. See more on digitalisation of Africa's agricultural systems in part one.

There is a 'distancing' that happens in the process of financialisation - distancing of revenue generation far from the place of production, distancing of accountability as the entry of many stakeholders unrelated to food and farming obscures responsibility, and distancing (almost erasing) of the physical form of food production, including of those who produce it and their related knowledge.

You can read the briefing paper here and the associated fact sheet here.

This paper describes key financial instruments like futures and derivatives trading markets, and index funds. It also explores the financialisation of climate change and the role of public private partnerships. Significant financialisation actors are identified, such as banks, asset management funds, large institutional investors and philanthropic organisations. Agricultural commodity trading companies are engaged with financialisation instruments like derivatives, as are global energy traders. Digitalisation is an enabler of financialisation. See more on digitalisation of Africa's agricultural systems in part one.

There is a 'distancing' that happens in the process of financialisation - distancing of revenue generation far from the place of production, distancing of accountability as the entry of many stakeholders unrelated to food and farming obscures responsibility, and distancing (almost erasing) of the physical form of food production, including of those who produce it and their related knowledge.

You can read the briefing paper here and the associated fact sheet here.

No comments:

Post a Comment