Key findings for Western and Central Africa

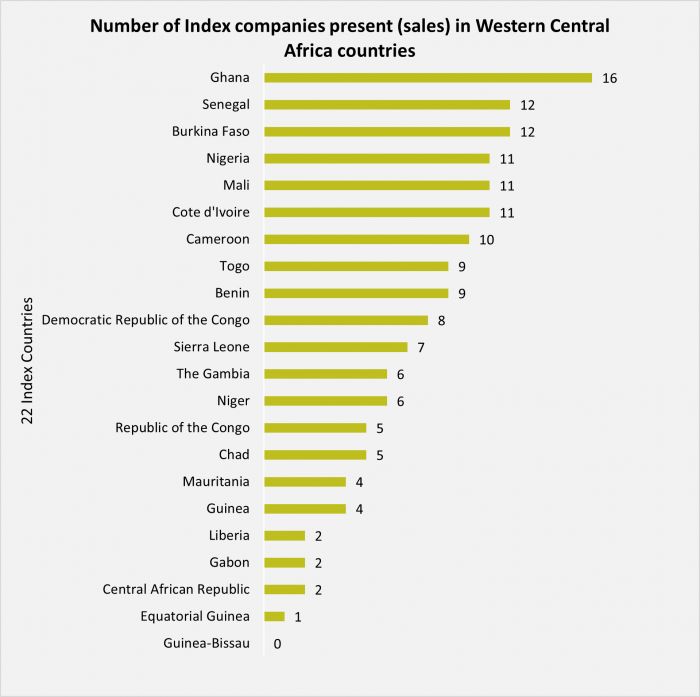

The 2021 Access to Seeds Index evaluates the efforts of 32 leading companies in Western Central Africa on six measurement areas.- Showing a presence with sales of both global and regional companies in 21 indexed countries except Guinea-Bissau. Company extension services support sales in 18 countries, six more countries than in 2019, but are entirely lacking in countries.

- In Western and Central Africa, almost all index countries have two or more companies present with the most presence in Ghana (16 companies), Senegal (13), Nigeria (13), and Burkina Faso (13). The only country with no company presence reported in 2021 is Guinea-Bissau.

- Overall, the seed industry in the region is still in its early stages of maturing. A few companies, mainly regional, invest in local business activities such as breeding programs, seed production, and seed processing, particularly in Nigeria, Ghana, Burkina Faso, and Côte d’Ivoire. Some companies involve smallholder farmers in seed production activities to produce seeds under contractual arrangements, which helps generate income and transfer knowledge. An area of improvement identified within business activities was the lack of adequate systems to ensure social and labour standards across seed production activities.

Key findings Eastern and Southern African

The 32 companies assessed for Eastern and Southern African are present in all 19 countries, with two or more companies present per country. However, companies report a low presence in Burundi, Lesotho, Somalia, and Eswatini. Companies with the most extensive presence in the region are Seed Co and Corteva Agriscience, both with presences in 16 countries.Many companies are providing more diverse portfolios for vegetables and field crops but need to offer more pulses to help tackle malnutrition

Company crop portfolios are diverse for vegetables and field crops but pulses high in protein are few or lacking in portfolios, particularly in South and Southeast Asia. Companies are responding to the needs of smallholder farmers by offering both open-pollinated and hybrid varieties for many crops, as well as seed for a diverse set of local and traditional crops.Leading seed companies are offering extension services in more countries

Smallholder farmers need support beyond their purchase of seeds to adopt improved agricultural technologies and realise the potential of high-yielding crop varieties through capacity building. Extension services targeting smallholder farmers have increased in recent years, but there are gaps in Western and Central Africa.A key finding was the increase of ICT-based solutions to provide extensions services across regions – especially in Africa – as a consequence of worldwide travel and physical trade restrictions due to the COVId-19 pandemic. The seeds companies themselves, or in partnership with local organisations, have to ensure that every farmer has not only access to quality seeds, but also the right knowledge and tools to realise the full potential of high-yielding crop varieties on their small farms – without depleting natural resources or harming the environment.

No comments:

Post a Comment